Federal Reserve Cuts Interest Rates by 0.50%

I wanted to share some important news from the Federal Reserve that could significantly impact homebuyers and homeowners.

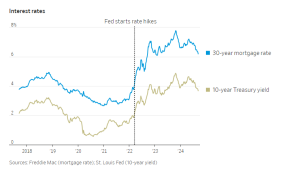

Earlier today, the Fed announced a 50 basis point cut to interest rates, bringing them down to a range of 4.75% to 5%. This marks the first rate reduction since 2020 and represents a key shift in the central bank’s approach to stimulating the economy.

What does this mean for you?

With this rate cut, mortgage rates are expected to decrease, which could make home loans more affordable and increase purchasing power for potential buyers. Refinancing opportunities may also become more favorable, offering a chance to reduce monthly payments and save on long-term interest.

In a recent interview with DC News’ Shennekia Grimshaw, housing expert Brian Coester explained that this move is expected to have a positive impact on the housing market, as lower rates often lead to improved affordability. Whether you’re looking to buy your first home, upgrade, or refinance, now could be a great time to explore your options.

In a recent interview with DC News’ Shennekia Grimshaw, housing expert Brian Coester explained that this move is expected to have a positive impact on the housing market, as lower rates often lead to improved affordability. Whether you’re looking to buy your first home, upgrade, or refinance, now could be a great time to explore your options.

Watch Brian Coester’s Interview:

If you’d like to discuss how this rate cut might benefit your specific situation, please don’t hesitate to reach out. I’d be happy to provide guidance and answer any questions you may have.